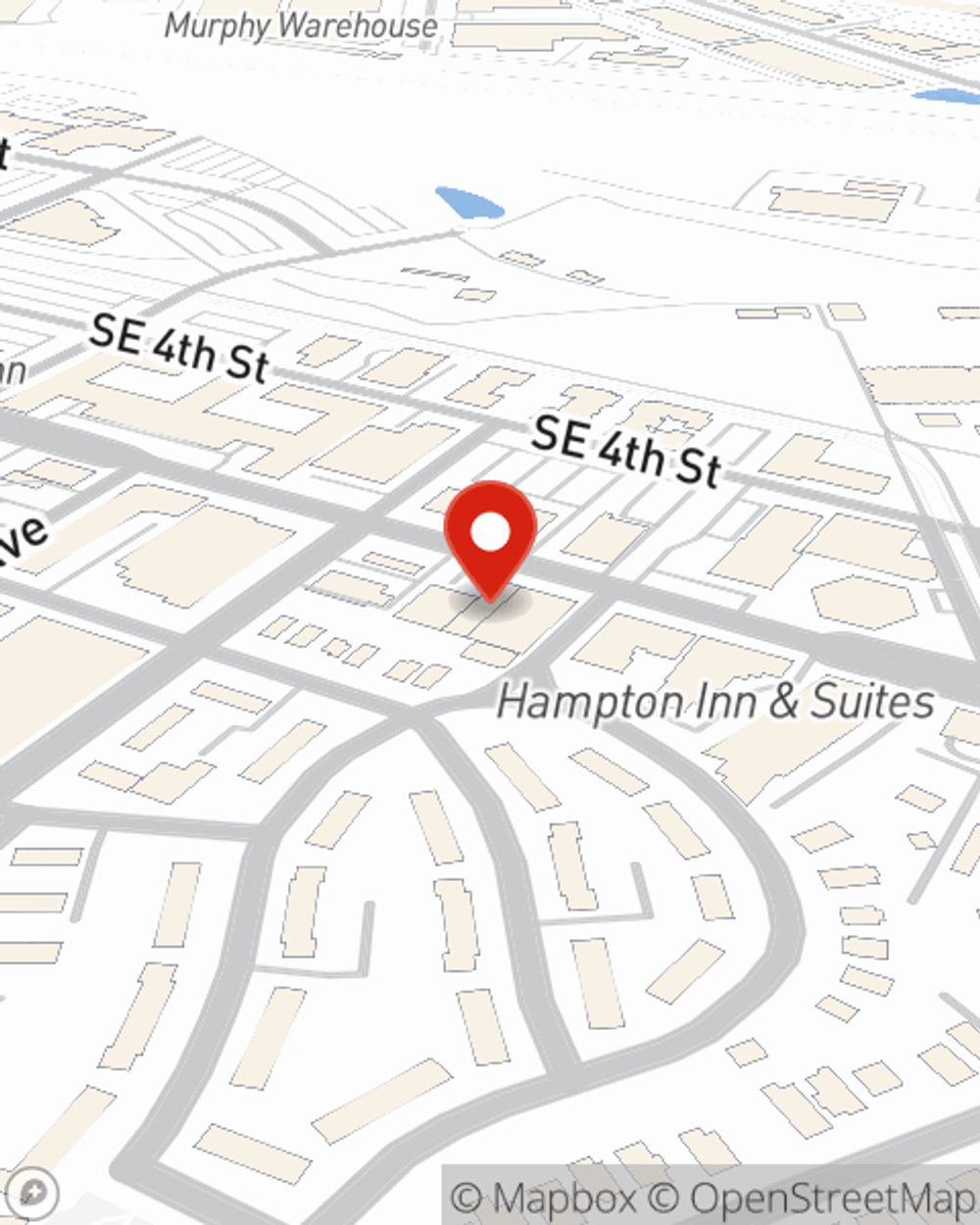

Business Insurance in and around Minneapolis

Researching protection for your business? Search no further than State Farm agent Kim Nybo!

Helping insure businesses can be the neighborly thing to do

- Columbia Heights, MN

- Minneapolis, MN

- Fridley, MN

- Hudson, WI

- Roseville, MN

- North Mpls, MN

- New Brighton, MN

- Blaine, MN

- Brooklyn Center, MN

- Iowa

- North Dakota

- Wisconsin

- Minnesota

- South Mpls, MN

- St. Paul, MN

- Coon Rapids, MN

- Maple Grove, MN

- Vadnais Heights, MN

- Champlin, MN

- Dayton, MN

- Osseo, MN

- Stillwater, MN

- Woodbury, MN

- Baldwin, WI

Coverage With State Farm Can Help Your Small Business.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

Researching protection for your business? Search no further than State Farm agent Kim Nybo!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Kim Nybo can also help you file your claim.

Take the next step of preparation and get in touch with State Farm agent Kim Nybo's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Kim Nybo

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.